Tax Preparation Services

Tax period management is a primary concern for most CPA firms and accounting firms. They are faced with time constraints to cope with delays due to cumbersome files and thus come into the image services from outsourcing companies like PTC.

We provide outsourced tax preparation in the USA. We are well-acquainted with the regulations, forms, and instructions needed to provide the best-outsourced tax return preparation services.

At PTC, we are well-acquainted with the regulations, forms, and instructions needed to provide the best-outsourced tax return preparation services. We help CPA firms, tax companies, and SMEs manage their workload and navigate the tax season smoothly. As a trusted outsourced tax partner, our team of tax experts manages the tax preparation work with a quick turnaround.

We are very detail-oriented & methodical with our approach, and our specialized staff process tax returns and prepare well-defined work papers to facilitate the overall review process. We analyze clients’ financial statements and relevant information in detail for proper classification and to optimize clients’ tax liabilities. We support you in the preparation of federal and state taxes both for Individuals and Corporates.

The main benefit of outsourcing tax services is it helps CPAs and other accounting firms to focus on high-value-added services such as tax planning and advisory services which are more lucrative. It also helps businesses concentrate on their core business and daily deliverables. Experienced outsourcing partners like PTC not only prepare returns but also helps in tax-planning and standardizing and streamlining workflow e.g., organizing work papers and supporting documents in digital folders so that they can be traced easily in the future.

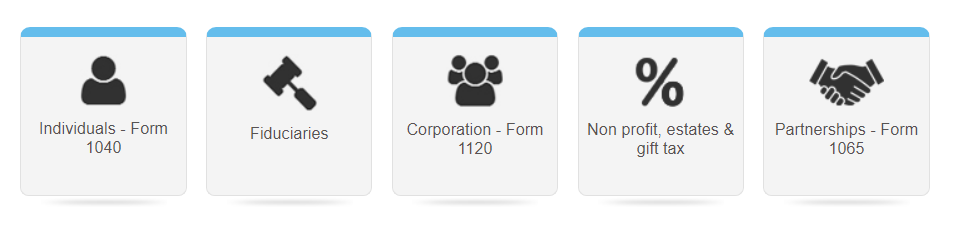

We provide Tax Preparation Outsourcing Services for the following:

We provide Tax Preparation Outsourcing Services for the following:

Tax Software we use: